Digital escrow made easy

How TradeSafe works

TradeSafe’s escrow protects buyers and sellers by holding the buyer’s funds in an escrow holding account until the seller delivers the goods or fulfils their obligations. Buyers get what they paid for, and sellers are guaranteed payment.

Vanguard Enterprises is on an acquisition drive and has identified a company: Premier Ventures

Vanguard Enterprises creates an account with TradeSafe. They load their business details and undergo a swift company verification process.

Within two hours, their business account is verified, and they are ready to transact!

They can also upload any documentation, such as the term sheet or the Sales Purchase Agreement (SPA).

Vanguard Enterprises inserts the email address of the selling party onto the system, and – swoosh! – TradeSafe sends off a transaction invitation to Premier Ventures.

If any adjustments or negotiations are required, both parties can communicate through the TradeSafe platform until they agree to the final terms of the merger and acquisition deal.

Payment can either be made by manual EFT, Ozow or with funds already in Vanguard Enterprises’ escrow wallet.

TradeSafe will issue Premier Ventures a signed letter of comfort once the funds have been cleared.

Both parties confirm that all conditions have been met, and authorise TradeSafe to release the funds held in escrow.

Mzansi Airlines wants to sell a second-hand Cessna to Glide Aviation

Mzansi Airlines creates an account with TradeSafe. They load their business details and undergo a swift company verification process.

Within two hours, their business account is verified, and they are ready to transact!

They can also upload any documentation such as photos, sales agreements, pro-forma invoices, or purchase orders to support their transaction.

Mzansi Airlines inserts the email address of the buying party into the system, and – swoosh! – TradeSafe sends off a transaction invitation to Glide Aviation.

Glide Aviation has used TradeSafe before, so they quickly log into their TradeSafe account to review the deal. Happy with the terms, they accept the transaction. If the terms were not to Glide Aviation’s liking, the parties could easily use TradeSafe’s negotiation feature to reach a middle ground.

Standard Bank has management oversight of the escrow account, ensuring maximum security. TradeSafe will issue the seller with a signed letter of comfort.

Mzansi Airlines can upload tracking information to the transaction (such as the tracking number and the delivery company name) so that all parties can monitor the progress of the delivery.

If something was amiss (like a visible scratch), then Glide Aviation can request an adjustment to the agreement. If there was a misrepresentation (like a missing wing), then they could initiate a dispute.

(Please visit our FAQ to learn more about adjustments and TradeSafe’s dispute resolution process.)

Harvest Haven is a wholesaler of agricultural products

TradeSafe verifies their company documentation, and their account is approved.

Once the transaction has been compiled, Harvest Haven enters the customer and seller details onto the platform, and TradeSafe sends trade invitations to each party. TradeSafe ensures the confidentiality of the transaction to prevent circumvention.

Greenfield Farms can access the specific details of Harvest’s transaction but cannot see the supplier's information or profit margin. After carefully reviewing the terms, Greenfield Farms accepts Harvest Haven’s transaction.

CropCare can view the transaction details, while Harvest Haven’s profit margin and Greenfield Farms’ information remain confidential. Confident in the transaction, CropCare accepts the transaction.

Once the payment is verified and cleared, TradeSafe issues CropCare a signed letter of comfort, assuring them that the funds are safely held in escrow and designated for their company, if they deliver what was contracted.

Upon receiving the products, Greenfield Farms conducts a thorough quality inspection to ensure it meets their standards. Satisfied with the product, they authorise TradeSafe to release the funds.

In the case of any quantity discrepancies or adjustments, Greenfield Farms and CropCare can resolve the matter through TradeSafe’s platform. Any agreed-upon refunds or adjustments can be processed directly to Greenfield Farms’ bank account or credited to their escrow wallet for future transactions.

(Further details regarding dispute resolution and adjustment processes can be found in TradeSafe’s FAQ section.)

Similarly, TradeSafe ensures that Harvest Haven receives their profit margin.

Joe is a website developer

Joe signs up a TradeSafe account and completes his profile.

He then creates a freelance transaction and structures the transaction by milestones.

Joe creates four milestones, each with their own description, price, or percentage to be released, delivery period, and trigger release event. Joe slots in the email address of the client onto the system, and VOILA! TradeSafe sends off a trade invitation to the client.

Both parties can negotiate the deal if either party is not happy with the price or milestones using the TradeSafe platform.

Now that the terms have been agreed by both parties, Qhawe deposits the funds in full via EFT with TradeSafe to be held in escrow. Payment can either be made by manual EFT, Ozow or with funds already in Qhawe's escrow wallet.

Standard Bank has management oversight of the escrow account, making the funds doubly secure. TradeSafe will notify the parties once the funds have been cleared and issue Joe with a letter of comfort.

Joe cannot wait to be paid 25% of the project fee when he delivers the work to Qhawe.

(Should the first milestone not be up to scratch, Qhawe can either reject the milestone release or request an adjustment to the milestone price – a portion would be refunded either back to her bank account or her escrow wallet.

Further details regarding dispute resolution and adjustment processes can be found in TradeSafe’s FAQ section.

Familiar now with the process, Joe gets cracking on the next milestone.

Meditech wants to invest in a Biotech start-up called Biomed Pharmaceuticals

Meditech creates a TradeSafe account and completes their profile, providing the necessary information and documentation for verification.

Meditech creates a transaction through TradeSafe, selecting the drawdown option. They enter a description of the investment, the capital amount, and provide other relevant documentation.

Meditech includes the email address of the CEO of Biomed Pharmaceuticals, Sarah, and TradeSafe sends a trade invitation to her.

She signs up on TradeSafe, and the platform verifies Biomed Pharmaceuticals' corporate documents.

After her company has been approved by TradeSafe, Sarah on behalf of Biotech accepts the transaction's terms as created by Meditech.

TradeSafe, with the oversight of a trusted financial institution like Standard Bank, securely holds the funds in an escrow account. Once the funds are cleared, TradeSafe notifies the parties involved and issues Biomed Pharmaceuticals a signed letter of comfort, ensuring the security of the funds.

At a certain point, the company requires additional funds to acquire specialised laboratory equipment and conduct clinical trials.

Sarah signs into TradeSafe and issues a drawdown request to Meditech, specifying the amount needed by Biomed Pharmaceuticals. She uploads supporting documentation, such as the equipment requisition documents and invoices from suppliers.

In the event that any issues arise with the drawdown request, TradeSafe provides a robust mechanism to enable price adjustments or dispute resolutions.

Further details regarding dispute resolution and adjustment processes can be found in TradeSafe’s FAQ section.

All escrow account balances are automatically updated, ensuring transparency and accuracy.

Once the capital amount is fully depleted, the transaction is closed.

Funky Finds Emporium is a marketplace...

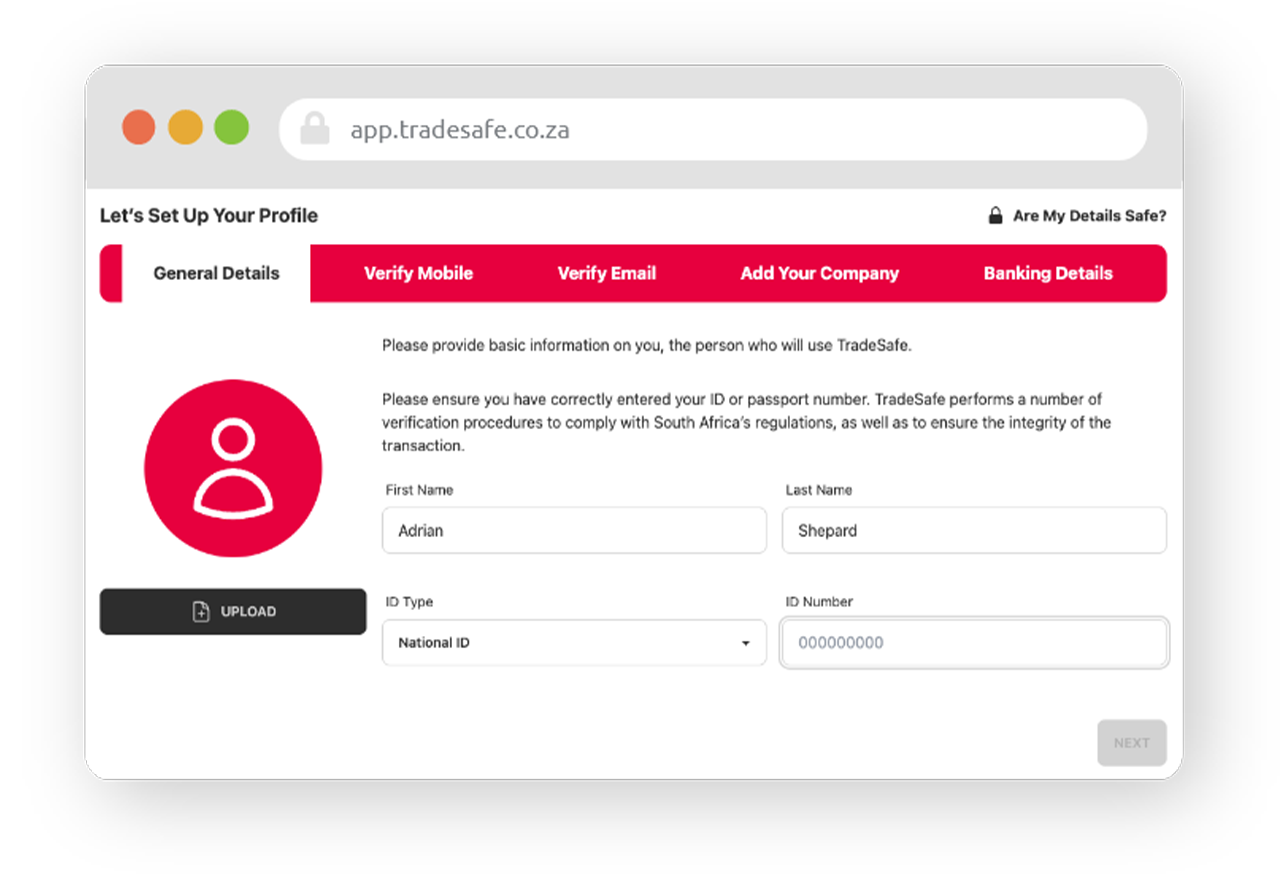

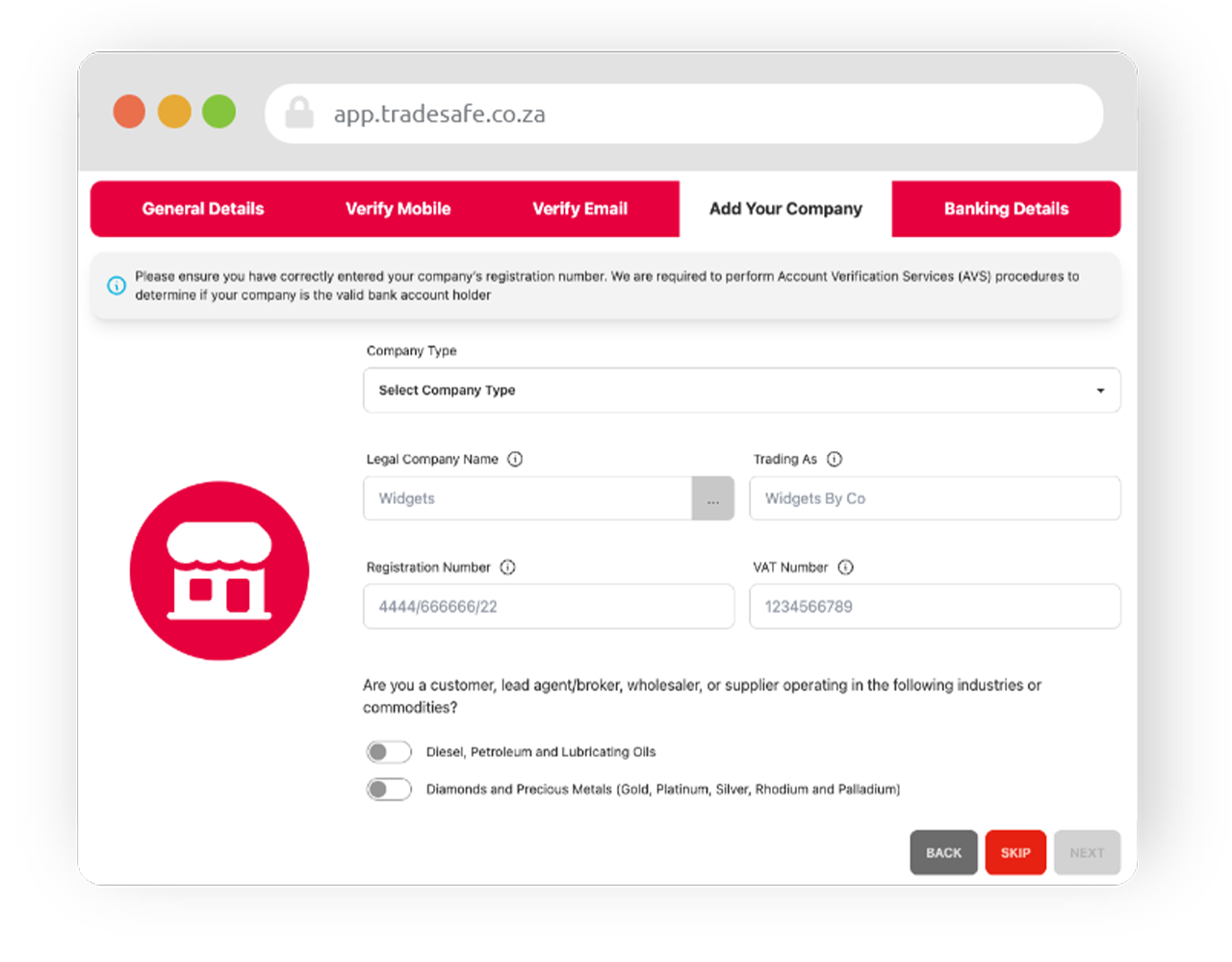

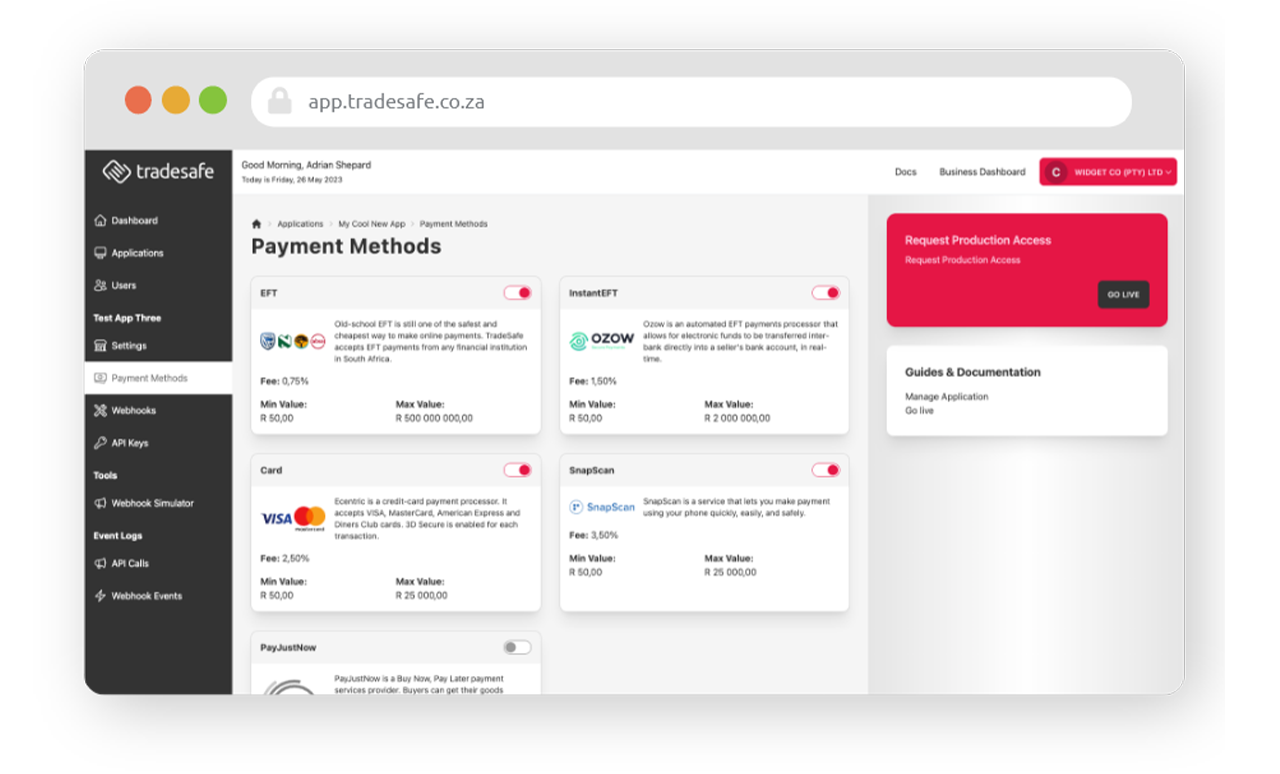

The user can have their organisation verified at this stage, or wait until they are ready to go to production.

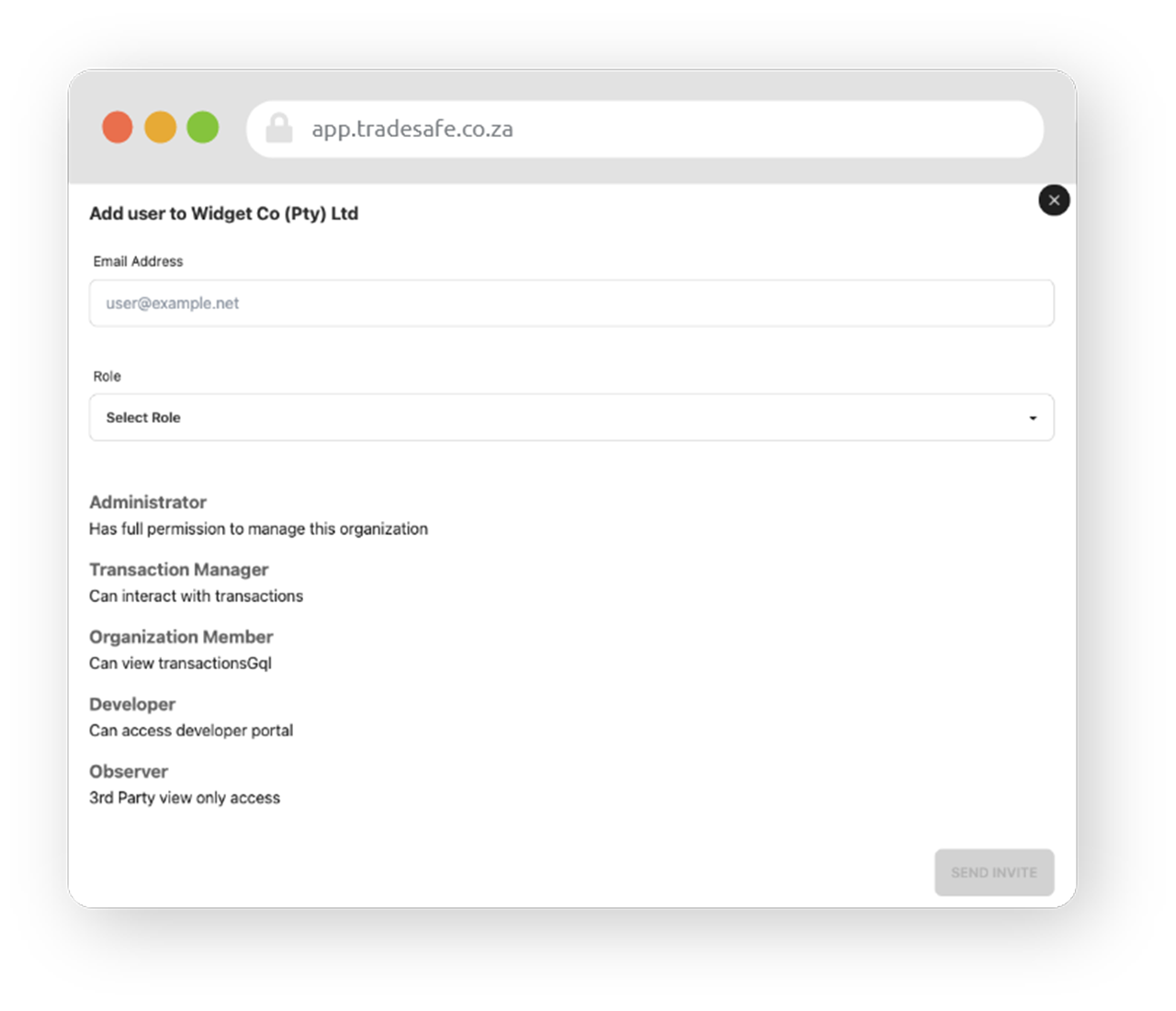

The CEO is not a technical person, so he invites his development team and adds them to the merchant account.

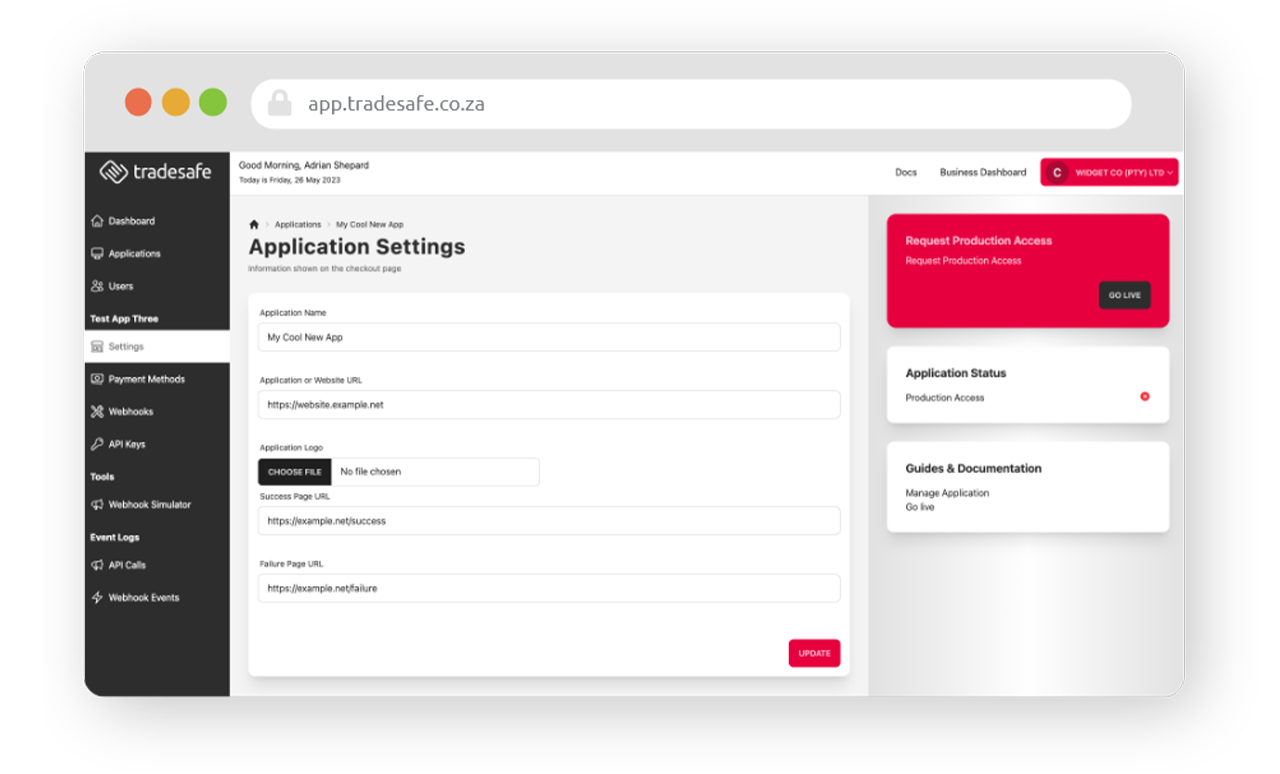

To set up an application between Funky Finds and TradeSafe, the developer has access to a number of playgrounds and other tools. They obtain their API keys at this stage.

More information can be found in the API documentation found here.

No real money is used in testing…

The account owner completes their organisational profile (if not done so already), and uploads a signed merchant agreement.

TradeSafe verifies all documentation, performs a Quality Assurance exercise of the integration , and then activates the account for production.

Funky Finds Emporium is now ready to transact.

Anyone can sell confidently with escrow

Individuals

Whether you’re selling a car or a collectible, TradeSafe’s easy-to-use digital escrow service helps you to outsmart scammers and make private sales safely.

Businesses

Sell with Standard Bank-supported escrow to enjoy upfront confidence in your buyers and eliminate the stress of not being paid.

Simon Just

Jan van den Handel

Executive Operational Finance

Prince Chiramba

Gavin Deysel

Daniel Trevethan

Beat the risk, with TradeSafe

TradeSafe is South Africa’s longest-running digital escrow service, protecting businesses and individuals from transactional fraud and bad debt.

million

in transactions processed across 40 industries

years

as the longest running escrow provider in Africa

merchants

using the TradeSafe merchant integration

Bank-supported

Insured

Audited

Compliant

Your money has never been safer

From multi-million rand commodity deals to antiques, luxury timepieces and second-hand cars, TradeSafe has been protecting online transactions since 2015.